Navy aircraft carrier operations are up 40 percent this year over last year, even as the service has fewer available for tasking due to maintenance and acquisition challenges.

From January through Oct. 31, U.S. carriers had spent a combined total of 855 days at sea – 258 days more than all of 2019, according to a USNI News analysis of carrier deployments over the last five years.

That heavy carrier usage makes 2020 the busiest year for the carrier fleet since the Arab Spring, forcing some carriers to stay on station for record-length deployments and conduct double-pumps even as others are sidelined and can’t contribute to the workload.

The National Defense Strategy in January 2018 called on the military to prioritize building up readiness and lethality for a future fight over routine low-end operations today, giving the Navy something it hadn’t had in almost two decades: a reprieve from keeping an aircraft carrier in the Middle East.

Since 2001, the Navy’s presence in the Middle East grew and plateaued to support a times a two-carrier presence there, with the sea service never seeing much of a break to come home and reset the way the Army and Air Force did during lulls and withdrawal periods. For two years, in 2018 and 2019, the Navy was allowed to drop from 25 percent of carriers operating at sea in 2017 to just 20 percent and then 16 percent. 2019 saw the lowest carrier usage rates in 25 years, after years of carriers being overworked and seeing subsequent maintenance challenges.

But then 2020 reversed that trend.

Today, the Pentagon is using up aircraft carrier readiness faster than the Navy can generate it.

The pace requires several carriers being asked to do double-pump deployments – two back-to-back deployments overseas without a major maintenance period in between – or curtail maintenance periods. This heavy use, paired with a backup at the East Coast aircraft carrier repair yard and the service being down a flattop due to the delayed entry of USS Gerald R. Ford (CVN-78) to the fleet, is putting significant strain on a small number of carriers while others are laid up and not contributing to the workload. It also calls into question whether the Pentagon will allow the Navy to redirect its spending and attention to modernize for a potential fight against China, or whether the service will continue to be bogged down by combatant commander demands such as providing heel-to-toe carrier presence to sail in a tight box of water off the coast of Iran.

Chief of Naval Operations Adm. Mike Gilday told USNI News in a recent interview that he was trying hard to keep deployments to about seven months, personnel tempos to about a two-to-one dwell-to-deployment rate, and ships coming into maintenance on time so they can leave on time.

Even despite less than half the carrier fleet being available for tasking, Gilday said he thought the Navy has “been fairly successful in that.”

But, he added, “the real world gets a vote, right? And so particularly with Iran and in CENTCOM, there have been real-world issues that have come up that have caused us to keep an aircraft carrier and a strike group on station. And you know, those are things that you can’t specifically plan for, you have to react to.”

State of the Carrier Fleet

Friends and family members greet the Nimitz-class aircraft carrier USS Dwight D. Eisenhower (CVN-69) as the ship returns to Naval Station Norfolk, Va., after a regularly scheduled deployment in support of maritime security operations and theater security cooperation efforts in U.S. 5th and 6th Fleet on Aug. 9, 2020. US Navy Photo

The East Coast has just one deployable carrier for the next year.

Due to maintenance logjams and the years-late entry of Ford to the fleet, U.S. Fleet Forces Command will only have USS Dwight D. Eisenhower (CVN-69) – the second oldest carrier in the fleet at 43 years old, with a history of maintenance challenges – to meet any operational requirements that arise. Fresh off a deployment with 200 days at sea without a port call due to the coronavirus pandemic, Eisenhower is slated to deploy again early next year, two defense officials confirmed to USNI News. No other carriers will be available to deploy from Virginia until at least the second half of 2021.

Though the West Coast fleet doesn’t face the same challenges as its Atlantic counterparts, it too will rely on a double-pump deployment – sending USS Theodore Roosevelt (CVN-71) back out after a deployment in the spring that was marred by a COVID-19 outbreak – to fully cover the Joint Force’s requirements of the Navy carrier fleet, Navy officials have confirmed to USNI News.

The situation means the Navy is burning limited carrier readiness today to keep a constant presence in the Middle East. It also means that the increasingly contested Atlantic theater could have a harder time getting limited East Coast carrier strike group assets to cover anti-submarine and anti-surface missions there, especially if there are any further hiccups in the Navy’s plans due to the COVID-19 pandemic or due to unforeseen maintenance challenges at the repair yards. Several Navy officials stressed to USNI News that the service deploys with a “one Navy, one fight” mentality and that West Coast carriers will be able to help cover all requirements from theater commanders, though they concede that California-based carriers would likely only deploy to the Pacific or the Middle East, not to European waters.

How We Counted:

USNI News uses a specific methodology to measure operational combat power. The totals are based on an internal database that does not count training exercises, certification cruises or other qualification underways, but rather only include operational carrier deployments focused on national tasking. For example: USS Gerald Ford (CVN-78) has been operating off the East Coast for almost a year launching and recovering aircraft, but it hasn’t been certified to deploy with a strike group, so those underways therefore are not counted.

In the case of the Navy’s forward-deployed carrier in Japan, which is technically always deployed, even while in maintenance, USNI News counts only its patrols as part of the deployment overview.

This strain in the carrier fleet to meet operational requirements, though 20 years in the making, comes as the Pentagon is looking to reshape the future naval force design. Carriers are perhaps the most at risk under former Defense Secretary Mark Esper’s calculus of getting the most bang for the shipbuilding and ship sustainment buck, as his Battle Force 2045 naval plan looks to smaller and less expensive platforms that can provide greater operational availability.

The Navy today has 11 commissioned aircraft carriers. USS Ronald Reagan (CVN-76) is forward-deployed to Japan and has its own unique schedule for maintenance and operations. Two carriers are currently tied up with mid-life refueling and complex overhaul (RCOH) activities: USS George Washington (CVN-73) is in the second half of its four-year overhaul, and USS John C. Stennis (CVN-74) is in pre-RCOH activities and should begin its overhaul late next year.

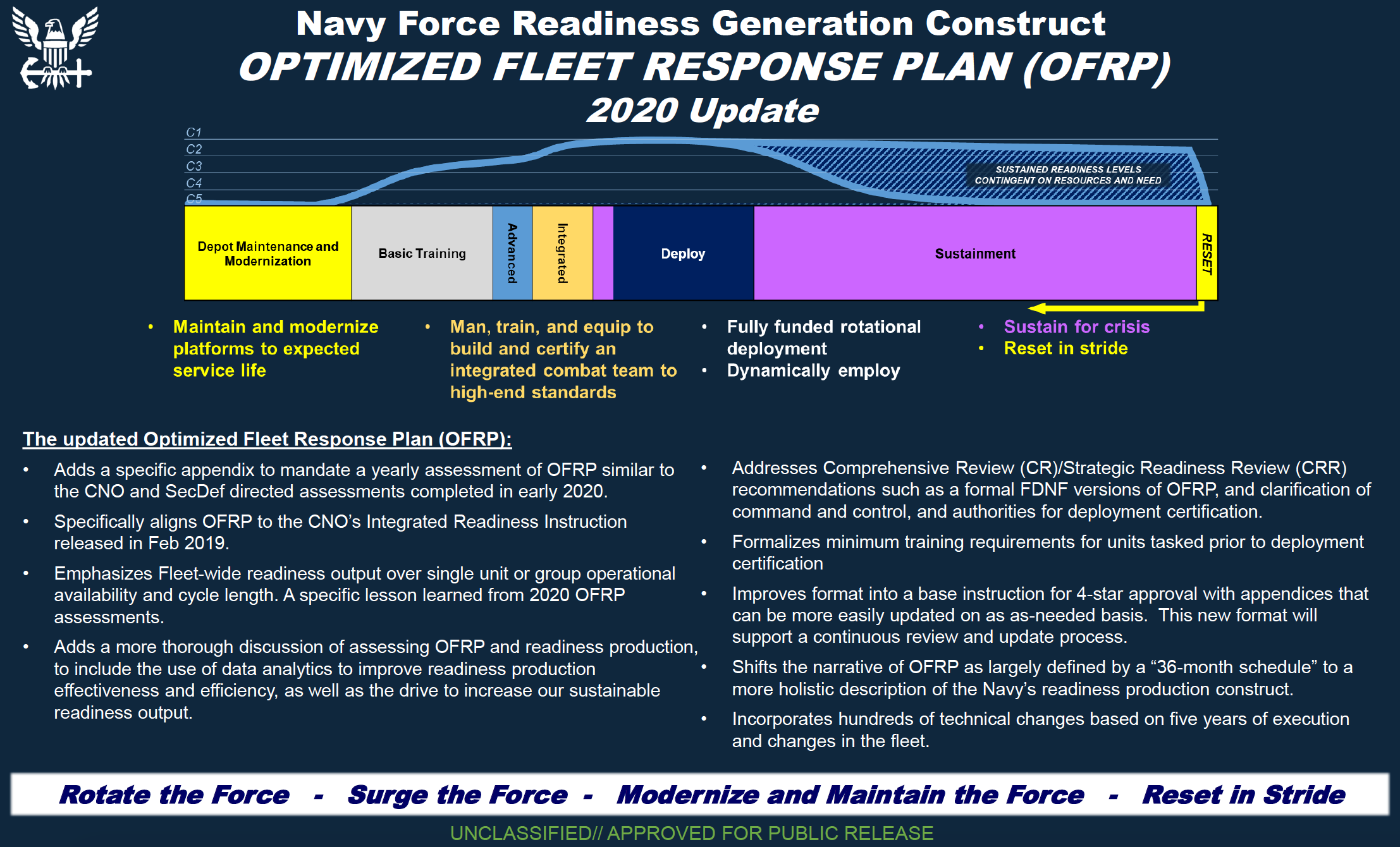

Under the Navy’s Optimized Fleet Response Plan (OFRP) that outlines maintenance, training and deployment schedules, for the remaining eight carriers – four each on the East Coast and West Coast – notionally, one carrier per coast should be on deployment, one should be working up for deployment, one should be back from deployment and sustaining its readiness, and one should be in maintenance.

That is the case today in the Pacific Fleet: USS Nimitz (CVN-68) is on deployment in U.S. Central Command. Theodore Roosevelt returned home from deployment in July and is expected to deploy again during its sustainment phase before heading to Puget Sound Naval Shipyard and Intermediate Maintenance Facility in Washington State next year for an overhaul period. USS Carl Vinson (CVN-70) recently arrived in San Diego to begin its training phase for a deployment next year. And USS Abraham Lincoln (CVN-72) completed the longest carrier deployment since 1973 earlier this year, coming home after 295 days deployed, and conducted pierside maintenance after its return.

The Ford-class aircraft carrier USS Gerald R. Ford (CVN-78) and the Nimitz-class aircraft carrier USS Harry S. Truman (CVN-75) transit the Atlantic Ocean on June 4, 2020. US Navy Photo

In Virginia, though, the ships are not adhering to the OFRP cycle as neatly.

USS George H.W. Bush (CVN-77) is about 20 months into a planned 28-month maintenance availability, which was scheduled to take a year and a half longer than a docking maintenance availability should actually take due to backups and slow performance at Norfolk Naval Shipyard and the rough condition of the carrier due to being worked hard in the years leading up to the docked availability.

USS Harry S. Truman (CVN-75) recently returned from the second in a set of back-to-back deployments and is now undergoing a maintenance period at Norfolk Naval Shipyard.

Ford is still conducting post-delivery tests and trials ahead of a shock trial next year and subsequent maintenance – even though its maiden deployment was originally scheduled for 2018.

That leaves just IKE to carry out any deployments from the East Coast until at least the second half of 2021– assuming there are no further delays at Norfolk due to the coronavirus pandemic, ongoing workforce challenges or growth work on Truman after its double-pump deployment.

Why is the East Coast Fleet Strained?

The aircraft carrier USS George H.W. Bush (CVN 77) is dry-docked at Norfolk Naval Shipyard (NNSY) in Portsmouth, Virginia, on April 23, 2019. US Navy Photo

Due to a string of programmatic delays with Ford, the East Coast is essentially down a carrier. Though Ford was commissioned in 2017, it won’t deploy until 2022 at the earliest – despite previous plans calling for an initial 2018 maiden deployment.

“She’s on track right now for the first deployment to be in ‘22. And we’re working closely with 2nd Fleet and with all of the stakeholders in this – PEO Carriers and the whole lot – to make sure that she is materially ready,” Commander of Naval Air Forces Atlantic Rear Adm. John Meier said at the Tailhook virtual conference on Sept. 12.

“[Ford commander Capt. J.J. Cummings] and his team are making sure that the crew will be ready. My team is doing everything to support that effort as a supporting commander. And our whole goal here is to put Ford materially – from an equipping perspective, from a training perspective and from a manning perspective – in position that” U.S. Fleet Forces Command and the chief of naval operations feel comfortable deploying the ship in 2022.

But deploying Ford in 2022 requires the Navy to complete work on the carrier’s Advanced Weapons Elevators, complete explosive full-ship shock trials and subsequent analysis and repairs, and begin training with an air wing and strike group without any delays – a tall order given the unpredictability of shock trials and COVID-19’s effect on the workforce.

The Navy earlier this year removed the CVN-78 program manager over performance issues, telling USNI News the service wanted a leader with a proven record of good performance during such a risky time for the carrier trying to join the operational fleet.

An EA-18G Growler, assigned to Air Test and Evaluation Squadron (VX) 23, prepares to take off from USS Gerald R. Ford’s (CVN-78) flight deck on Jan. 25, 2020. US Navy Photo

Rear Adm. Jim Downey, the program executive officer for aircraft carriers, told USNI News in an Oct. 7 interview that actions are being taken now to hasten Ford’s entry to the fleet, when the time comes.

USNI News has previously reported that the Navy and Newport News Shipbuilding are ahead of schedule with work being done on the carrier, doing work today that was otherwise planned to be done after shock trials. Downey said the team has now done 120 percent of the planned work and is on track to finish post-delivery test and trials on time, with more work than planned accomplished during the 18-month timeframe.

Shock trials should end by August 2021, and then the ship will need to go through more maintenance and then start workups for a 2022 deployment.

“We have been exercising her, more so now maybe than was forecasted a year or so ago, with early embarkation of the air wing and progressing to cyclic ops – and that’s to get Ford in the mix to be ready to take on more of the load here. So she may not be that far off on schedule to be ready to start on that,” Downey said.

“Ford right now, I think you’d hear from Fleet Forces, is at the top of their heavy-tasking list. She’s generated about 400 new pilots” and supported other pilots requalifying, he added. “So she’s been out in this environment in the last year almost 50 percent of that period, either doing TRACOM qualifications, other carrier quals, or cyclic ops with the strike group,” partly to contribute to some of the workload on the East Coast but also to get the ship crew and the air wing ready to jump into basic phase workups as quickly as possible after shock trials.

A second East Coast carrier – Bush – is out of the deployment rotation until at least early 2022. Its maintenance availability will run through the summer of 2021, if there aren’t further delays at the shipyard. After the repairs, the carrier would then have an extensive process of getting through trials, getting the crew re-certified, and entering basic training for its first deployment since 2017.

With Bush and Ford unable to deploy in the near future, the constantly busy Eisenhower and Truman are the only two carriers able to deploy from the East Coast.

From April 2018 to June 2020 Truman spent more than half that time – 422 days – deployed, according to a USNI News analysis of Navy deployment data. It is now in a seven-month “extended carrier incremental availability” maintenance period, which USNI News understands is a slimmed-down version of a planned incremental availability (PIA). The repair period would only tackle selected maintenance items, even though the carrier would be due for a lengthy docking planned incremental availability (DPIA) based on the generic Nimitz-class carrier maintenance plan. Truman is now set to go on its third deployment in three years without a full PIA or DPIA.

Earlier in the decade, Eisenhower did two sets of double-pumps with one maintenance availability in between – four deployments in five years with just one maintenance period in that time frame. Its subsequent 14-month maintenance period expanded to 23 months due to the great stress that had been put on the ship during that time. As a result of IKE’s delay, Truman was rushed out of maintenance after just three months and sent on a deployment that was extended to 240 days to keep a Middle East presence – this coming after its previous deployment went 270 days, according to USNI News data. Truman‘s maintenance period from 2016 to 2017 went as planned, but the ship has since conducted a two-part deployment of 101 and 110 days, and then a 211-day deployment that ended this summer. If it’s being asked to conduct another slimmed-down maintenance availability to get back out on station as quickly as possible, it’s unclear what it will mean in the long-run that two of the ship’s last three maintenance availabilities were curtailed even as its deployments were lengthy and numerous.

USS Dwight D. Eisenhower (CVN-69), left, and USS Harry S. Truman (CVN-75) transit the Arabian Sea behind the guided-missile cruiser USS Normandy (CG 60) during a photo exercise on March 21, 2020. US Navy Photo

Eisenhower too will have to double-pump again as a result of the limited options in the East Coast. Its deployment this year was strenuous, breaking records for at-sea time due to the COVID-19 pandemic that prevented the ship from coming in for port calls – which would have given the crew time for a break and also would have provided opportunities for some maintenance work that can’t be done underway. The last time IKE was ordered to go out for back-to-back deployments, 14 months of maintenance turned into 23. After a single deployment in 2016, Eisenhower’s maintenance still ballooned from six months to 19. IKE won’t go into planned maintenance until the summer or fall of 2021, and Truman will be in its pre-deployment training workups by then, putting a lot of pressure on Ike to stay in good working condition that whole time and on Truman to get out of maintenance on time, lest there be zero deployable carriers in Virginia.

Despite half the East Coast carrier fleet being out of the OFRP cycle and just one being capable of deploying now if needed, Deputy Chief of Naval Operations for Operations, Plans and Strategy Vice Adm. Phillip Sawyer told reporters recently that “the system continues to work.”

“We look at their schedules and say, okay, what can we do here to make sure the nation is getting the return on investment for that platform, whether it’s a cruiser, a submarine or an aircraft carrier. You could park everything next to the pier and have a lot of war reserve, but that’s not a real good return on your investment,” he said when asked about Theodore Roosevelt and Eisenhower facing double-pump deployments in the coming months.

“So it’s a balance between operations, we call peacetime presence, and the optempo for the ship and for the crew. And we balance that very carefully.”

Carrier Maintenance Improving, But Workload Still Too High

Mass Communication Specialist Seaman Trent Hawkins cuts metal during portable exothermic cutting unit training aboard the aircraft carrier USS Dwight D. Eisenhower (CVN-69) on April 14, 2020. US Navy Photo

Both coasts only have one shipyard that can accommodate carrier maintenance availabilities: Norfolk Naval Shipyard and Puget Sound Naval Shipyard and IMF. Both have been slowed down by also having to do Ohio-class ballistic missile submarine (SSBN) refueling work, which the Navy has acknowledged has put attack submarine maintenance work behind schedule, but Norfolk Naval Shipyard has also seen its carrier maintenance work affected as a result of too great a workload for the yard’s infrastructure and workforce.

While the Navy was upfront about Bush taking so long due to lack of capacity to work on it – hence the maintenance availability expanding from about 10 and a half months to 28 – Eisenhower also blew through its last availability there, partly due to the yard’s inability to dedicate resources to carrier maintenance and partly due to growth work in IKE’s maintenance package. IKE was supposed to go in for six months of work, which ballooned to 19 months.

The Navy is trying to get after these problems – the former commanding officer at Norfolk Naval Shipyard was removed on Sept. 21 due to poor performance at the yard – but officials responsible for deploying carriers still cite maintenance as the greatest variable and potential threat to their ability to deploy ships as planned.

“Aircraft carrier Ao readiness, or operational availability, that’s my number-one concern at AIRLANT, which is interesting because it’s also the one that I have the least control over,” Meier said during a second panel at Tailhook.

“The shipyards don’t work directly for us, and really AIRLANT and the commands, we partner … to meet those schedules as best we can. But embedded in that is the notion that we’ve got to get our carriers out of the shipyards on time. And more often than not, we’ve been having delays getting them out on time.”

“The budgetary pressure that we’re under right now, when we don’t get the return on investment, the enormous investment on our aircraft carriers, I describe it as a drop of blood in the water: Every day we lose of operational availability further fans the flames for critics that want to cut aircraft carriers,” Meier added.

A source familiar with the current pace of carrier deployments told USNI News, on condition of not being named, that “aircraft carrier maintenance, it is the driving component of our ability to meet the schedule. It is the largest, most complex, most costly aspect of an entire OFRP cycle for the carrier strike group. Including all of the units, the air wing, the cruiser, the destroyers. Everything that goes into a carrier strike group, the most complex and most challenging is aircraft carrier maintenance. It absolutely is a concern. Delays, or unforeseen extensions to maintenance – so a delay of Ford, or an increase in the length of time for Bush – those are concerns.”

USS Harry S. Truman (CVN-75) arrived at Norfolk Naval Shipyard on July 7 for an Extended Carrier Incremental Availability. US Navy Photo

Another source said on condition of not being named, “I think it’s pretty obviously that maintenance was the biggest driver of friction” for deploying carrier strike groups.

Despite the operational community’s concerns, the maintenance community notes performance is on the rise: nine of 10 carrier maintenance availabilities had ended on schedule – now nine of 12, due to some slight coronavirus-related delays this year – and the workforce is growing in its size and skillset.

This disconnect between operators’ concerns and maintainers’ focus on improved on-time rates may further grow: an ongoing initiative in the maintenance community to reassess how long maintenance periods should take would result in better planning and likely greater on-time delivery rates, but wouldn’t in itself shorten the time it takes to conduct lengthy maintenance availabilities. Bush, for example, may well come out of its 28-month availability on time, which would continue the trend of on-time carrier delivery but wouldn’t change the fact that the carrier was unavailable to the fleet for nearly two and a half years.

Downey, from PEO Carriers, said the biggest issue in his mind is the volume of work being conducted by ship maintenance yards. He acknowledged that fewer carriers are available for tasking than usual but said that across the Navy – and especially in the mid-Atlantic – there had been “a significant ramp-up across all ships coming out of [Fiscal Year 2016]. … ‘17 through now was about a 40-percent jump in investments in planned maintenance.”

Today, he said, using the Newport News Shipbuilding yard as an example, the shipbuilder is working with two carriers on their mid-life overhauls, is helping Ford through its post-delivery test and trials, and has three new carriers in various stages of construction.

“If you look at that yard and carriers only, you get into four, five, six carriers concurrently, two-thirds of them new construction, with the other ones very complex in the overhaul business. So there’s a lot of work going on there,” he said.

“You go over to Norfolk Naval and it’s very similar. As you get into carriers, as you get into submarine efforts, we have more hitting the fleet” as the fleet grows, further increasing the workload of the public shipyards in the coming years.

To his mind, much of this work comes from the heavy use of some of the carriers in recent years. Bush was worked hard in its first decade of life, contributing to the extremely lengthy 28-month DPIA. Truman was worked hard while that carrier was the only operationally available carrier on the East Coast, and now Eisenhower is being worked hard while it is the only operationally available carrier. All this is doable, he said, but a bill comes due later in the form of longer maintenance periods.

“Bush had a very heavy schedule prior to the DPIA, kind of right out of delivery back a decade ago,” Downey said.

Noting that about 70 percent of a maintenance work package is pre-planned work that comes from a class maintenance plan and the rest comes from the actual condition of the ship once inspections are conducted, he said, “although we focus on the 36-month cycle … the duration [of the carrier maintenance availability] is all driven by the conditions found. And Bush, generally, at the macro level, went to that 28 months based upon her employments in the prior years and the conditions we found and what had to get done there.”

Despite the heavy workload for the ship and the high volume of work stressing Norfolk Naval Shipyard, “we’re well through [Bush’s DPIA]. She’s through the high-risk evolutions, and she’s tracking to finish this next summer to plan. A lot of planning went into those adjustments for her. So although I do recognize it’s a longer period than was forecasted years ago, the team has held to that period, and that is not by added margin to that schedule, that is going through the critical path work.”

Hull Maintenance Technician 2nd Class Joshua Espinoza, from Houston, welds a bulkhead on a weather deck aboard the Nimitz-class aircraft carrier USS Harry S. Truman (CVN-75) in Portsmouth, Va., on Aug. 7, 2020. US Navy Photo

As for Truman, based on the resources available at Norfolk Naval Shipyard, the carrier will essentially get a slimmed-down work package that takes the length of a normal PIA, about seven months. The work package is being called an extended carrier incremental availability, which Downey said is a newer term meant to set expectations that this wouldn’t be a two-month CIA at the pier but also wouldn’t be a full PIA.

“There’s a lot of work in her extended CIA, and she is tracking to complete on time,” Downey said. The timing of the work changed a bit, after Truman was asked to hang out off the coast of Virginia for some time after it returned from deployment, in an effort to keep the carrier COVID-free until a West Coast carrier was certified and able to deploy. Despite the delay getting into the yard, in a bid to buy back some time and get Truman back out to the operational fleet, “to try to ensure readiness here through the avail, or by the end of the avail, the team has come up with a different activation approach for her such that at the middle of the avail they’re activating half the ship. Instead of trying to do it as it all finishes, that keeps the crew at a higher state of readiness and it gives us a halftime confirmation that she’s tracking to schedule.”

When certain systems – especially the reactor plant – are down for more than about six months, the crew has to go through recertification processes that they wouldn’t have to do for shorter stints away from their ship. In a bid to reduce those recertification requirements and quicken the timeline of getting Truman back up and running to relieve Eisenhower as the only carrier on watch, later this month or early next month the carrier will begin some of that reactivation, allowing sailors to resume operating the ship within that six-month window and cut down on the work they’ll need to do after the availability ends to get the ship back out to sea.

Specifically, Downey said, Truman’s ECIA will include work on both nuclear power plants, flight deck work, refurbishment of aircraft launch and recovery equipment and more that creates “a pretty extensive work package.”

Again, he noted that the ship’s heavy usage in recent years, particularly its double-pump deployment this last cycle, are extending the scope of the work package.

“There’s quite a bit of work throughout the ship on Truman, and the majority of it is what is planned, and the rest of it is a result of her extended underway and what was the result of those assessments” on the ship’s condition afterwards.

Living through the Drought

The Blue Angels flies over the Nimitz-class aircraft carrier, USS Harry S. Truman (CVN-75) on May 20, 2020. US Navy Photo

As tough as the next year will be for Eisenhower, 2021 will usher in a better environment for the East Coast fleet. Truman is planned to come out of its maintenance availability in February, meaning it could deploy in late summer or early fall. Bush would come out of its DPIA in the summer of 2021, perhaps in June or July, setting it up for a 2022 deployment. And Ford is on track to conduct its full-ship shock trials from April to August 2021 and then head into maintenance to fix whatever is needed after the explosive in-water event, also setting it up for a 2022 deployment.

But for now, the Navy not only needs Eisenhower to remain in good working condition, it needs the crew to remain COVID-free, it needs the Norfolk Naval Shipyard and Newport News Shipbuilding workforces to avoid an outbreak that would slow down work, and it needs to hope that no tensions flare-up that would require any kind of surge force to deploy – since there’s no margin left on the East Coast.

Fleet Forces Command repeatedly told USNI News they don’t view the carrier fleet as East Coast versus West Coast and that any carrier can deploy to any location around the globe.

“We’re one global force – one fight, one Navy. The decision to deploy aircraft carriers is not based on whether or not it is an East or West Coast ship, but rather what is the combatant commander requirement and what carrier strike groups are available to meet that requirement based on their progression in the [Optimized Fleet Response Plan] construct,” Rear Adm. Paul Spedero, the Fleet Readiness Officer at Fleet Forces Command, told USNI News in an August interview.

Downey told USNI News that “our job is to reset these ships and help create the readiness for the fleet to consume. We’ll pay very close attention to the East Coast as well and make sure Truman and Bush go to their schedules, or if anything that comes up different from what’s planned, we’re informing the world here on how that’s going.”

Still, CNO Gilday told USNI News that he struggles with how to balance his responsibilities as a member to the Joint Chiefs of Staff and advisor to the defense secretary and the president with his responsibilities as the admiral in charge of manning, training and equipping the Navy. He said that, in his view, only five of the 11 carriers are in play today when it comes to global operations, and he has to balance what the joint force needs with what’s healthy for the Navy.

“That denominator is not 11 right now. it’s really only five. And so I need to judiciously watch how we use – you know, the length at which we keep those carriers on deployment. And what I aim for is between seven and about eight and a half months. And so I can’t promise to get a carrier back in seven months anymore, just based on the world situation. So I’m really looking at between seven and eight and a half months,” he said.

“But I try to keep PERSTEMPO at about a two-to-one dwell. And I try to make sure that we’re able to maintain that heel-to-toe cadence of getting aircraft carriers and [cruisers and destroyers] and submarines into the shipyards on time.”

He said he tries his best to adjust schedules so that deployed carriers can be relieved on time and sailors come back home, but with so few carriers available for tasking, that job is harder now.

Gilday added that much of that balance of deploying now versus restoring and preserving readiness for the future comes down to decisions by the SECDEF. He said former SECDEF James Mattis understood that, which is shown in the lower carrier-usage figures USNI News has calculated. Gilday said Esper had been trying understand what the Navy needed to build up its readiness and therefore how much presence it could generate on top of that.

Gilday did express hope for the future: despite so many carriers being in maintenance today and not being available to share in the burden of today’s workload, the fact that they’re in maintenance at all is an improvement on the past.

“A big difference, if I compare what’s going on today with respect to readiness and force generation compared to, let’s say, eight or nine years ago, is that we’re actually doing the maintenance. And we weren’t then. We were just deferring it, right? Which I think gets to the real issue of your point,” he said.

“What you were really trying to say is: Hey, Gilday, aren’t you going to put the Navy in the same trouble that you were in, you know, eight or nine years ago? And the answer is, no. I think we’re watching it a lot more closely, and we’re actually doing the maintenance.”

Tomorrow’s Effects from Today’s Challenges

Sailors paint the port side exterior of the Nimitz-class aircraft carrier USS Abraham Lincoln (CVN 72). US Navy Photo

The Navy today has four carriers totally sidelined from deployment activities – due to timing, two are wrapped up in RCOH instead of just one; due to maintenance backups in Norfolk, another is losing a year and a half of time; and due to a series of acquisition setbacks and delays, the newest carrier remains unable to get into the deployment queue.

With just four continental U.S.-based carriers able to shoulder the burden of deployments and pre-deployment workups today, they’re still taking on a full slate of work. The Joint Force, working through the Global Force Management System, has kept a carrier in the Middle East nonstop since the spring of 2019. It has also had two and sometimes three carriers operating in the Indo-Pacific, as a hedge against an increasingly expansive Chinese Navy.

By straining four ships to do the work of 11 carriers, a top concern is betting future readiness – of the ships, the aircraft and the sailors – to meet current global demands.

The focus on the Middle East and the Western Pacific leaves fewer assets to operate in the Atlantic to face the growing Russian submarine threat. The Navy had touted Truman’s 2018 deployment as a model of dynamic force employment, eschewing expectations that the carrier would rush to the Middle East and instead deploying to the Mediterranean, to the North Atlantic and north of the Arctic Circle to focus on anti-submarine warfare skills and working with allies that would be key to keeping the Russian submarine fleet in check.

Looking forward, the nuclear-powered carrier fleet could be further constrained. A Battle Force 2045 future fleet design Esper announced this month calls for between eight and 11, though past public comments by Esper and others suggest that savings in the carrier fleet could be used to fund growth in small and unmanned ships.

Esper said he doesn’t want to cut funds from the Navy supercarrier fleet because he doesn’t support it – in fact, he told USNI News during a recent trip to San Diego, “I empathize with the Navy [on maintenance issues]. I want to help them solve this issue” — but he’s also not happy with their operational availability.

His chief spokesman, Jonathan Hoffman, added that the secretary wants to explore new paradigms on how ships deploy and are used. DoD and the Navy had both already undertaken a review of OFRP to see if it’s the most efficient model for planning carrier availability, and new ideas on how to use the carriers or even supplement them with light carriers are being discussed in light of Battle Force 2045.

For the Navy’s part, Fleet Forces just this month signed off on an OFRP update, U.S. Fleet Forces Command told USNI News.

“We are looking forward to the release of the new OFRP Instruction,” Spedero told USNI News ahead of its Oct. 20 release.

“This new revision is the first formal update since OFRP was introduced in 2014. The new instruction will emphasize Fleet-wide readiness output over single unit/group operational availability and cycle length, a specific lesson learned from the 2020 OFRP assessments.”

Fleet Forces Command spokesman Lt. Cmdr. Rob Myers told USNI News on Oct. 27 that six years of lessons learned from using the OFRP model led to several changes in this update: a mandate for yearly reviews to ensure the plan is still working, the introduction of data analytics to monitor and increase readiness production, formalizing minimum training requirements ahead of deployments, a call to formalize an OFRP version for forward-deployed forces, and more.

The commanders of U.S. Fleet Forces Command, U.S. Pacific Fleet and U.S. Naval Forces Europe released a 12-star signed revision of the Navy’s Optimized Fleet Response Plan Instruction on Oct. 20. Myers said the leaders hoped to shift how OFRP is framed: rather than being a 36-month schedule that all ships in a carrier strike group should adhere to, he said the leaders want OFRP viewed as a construct for overall naval force readiness.

“The product of OFRP is units ready for employment, on time and to standard. OFRP values aggregated output efficiency and effectiveness, over individual unit or group,” he said. “OFRP provides the construct to maximize readiness production in a resource-constrained environment.”

One lawmaker – Rep. Rob Wittman (R-Va.), the top Republican on the House Armed Services seapower and projection forces subcommittee – told USNI News that “I am concerned, I would not be forthright if I said I was not concerned” about the carrier fleet and the efficacy of OFRP.

Though he said the Navy has told the subcommittee that everything is fine, “the problem is, from my viewpoint, is I think the issues that they’re dealing with are long-term issues. So I don’t think they’re easily solvable tomorrow to where you’re going to make up maintenance backlogs on nuclear aircraft carriers. And they are also a product of very very old dry docks. So when you combine that with a shortage of labor in the workforce, you combine that with having difficulty recruiting new shipyard workers to very old and antiquated facilities, when you combine that with extended overtime that burns workers out, that doesn’t appear to me to be a successful formula to anywhere in the short term being able to address this particular issue,” he said.

The Navy has a 20-year, $21-billion plan to overhaul the four public yards that maintain carriers and submarines, but Wittman said that timeline isn’t fast enough to save the carrier fleet from being worn down.

He said agreements with local and state governments and educational institutions have led to a healthy pipeline of recruits to work at the yards, but “the key, though, is retaining those workers. When they go to a yard and look at it and go, wow – I look at Norfolk Naval Shipyard and I look at where I work there, and then I look at BAE [ship repair yard] just down the road and I look at the workplace and the work conditions there, and I say, well, you know, I’ll develop my skills at Norfolk and then I’m going to go to one of the private yards that’s more modern, that does things differently. It is very, very difficult, and we’ve seen a pretty steady procession of workers from the public yards to the private yards. And you have to have a long-term solution: the long-term solution is not just the training pipeline, which I think the capacity is there, and the recruitment of shipyard workers and the ability to attract them with salaries and benefits; but they key is how do you retain them by having workplace conditions that are modern, that provide a level of comfort and positivity with the shipyard workers, and that’s going to be their challenge going forward. And that’s why recapitalization of these shipyards is key.”